SNB Won't Let EUR/CHF Fall

What happened?

It looks like the decline in EUR/CHF to 1.07 has got the attention of the Swiss National Bank (SNB). An increase in sight deposits by over 1 billion CHF in the past two weeks suggests that intervention has resumed. SNB’s goal is to avoid CHF strengthening. That is why if EUR/CHF drops down to 1.05, SNB will intervene.

At the moment, EUR/CHF correlates with EUR/USD. If EUR gets weaker as Federal Reserve tightens monetary policy, it will create issues for SNB.

According to experts’ opinion, EUR/CHF is going to consolidate between 1.05 and 1.1 in the middle-term perspective.

Technical analyses

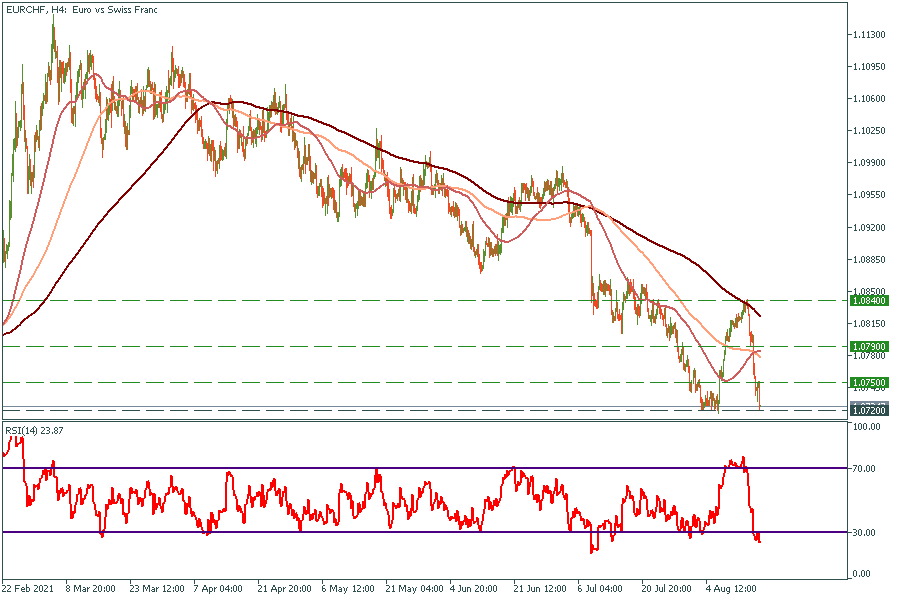

4H Chart

EUR/CHF dropped to its 1,072-support driven by the strong impulse. At the moment, a pullback to the 1,075 level is expected. If the price breaks through, the next target will be 1.079. On the other hand, if the pair breaks through 1,072, the next support levels will be 1,068 and 1,063.