Trade idea

SELL 1.0750; TP1 1.0725; TP2 1.0700; SL 1.0765

The Australian dollar will likely be quite volatile on Tuesday as the Reserve Bank of Australia Governor Philip Lowe is scheduled to speak at 12:55 MT time. The RBA will likely be under pressure to cut rates further, so we await some negative impact on the AUD.

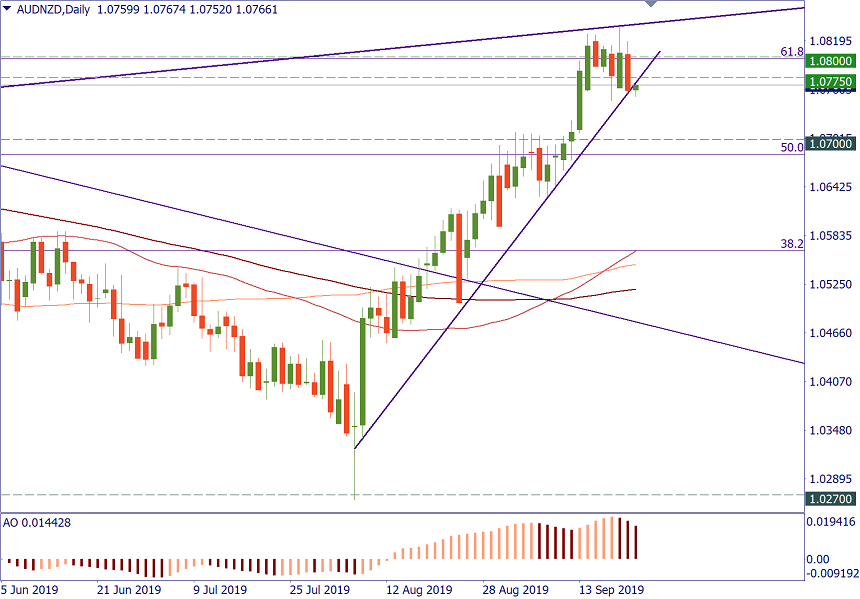

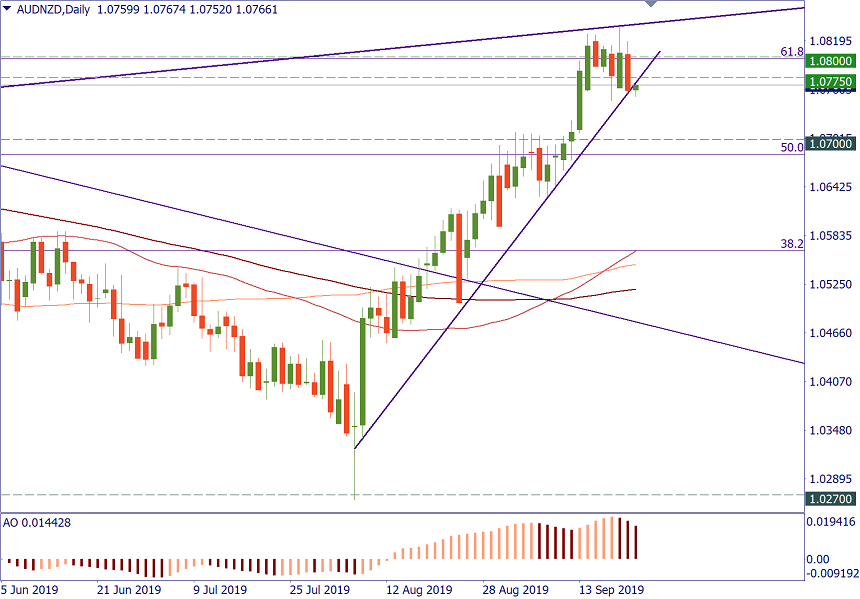

There are good levels for shorts below support in AUD/JPY and AUD/CHF, but in this article, we’d like to have a look at AUD/NZD. The pair has reached the resistance of the 61.8% Fibo of the 2018 decline in the 1.0800 area. The line connecting the 2019 highs also lies here. The attempts of the Aussie to get higher were so far unconvincing. On H4, the pair is below the 50-period MA at 1.0775. This previous support may now act as resistance. The inability to return above it will lead AUD/NZD down to 1.0725 (100-period MA on H4) and 1.0700 (200-week MA).