Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2021-08-20 • Updated

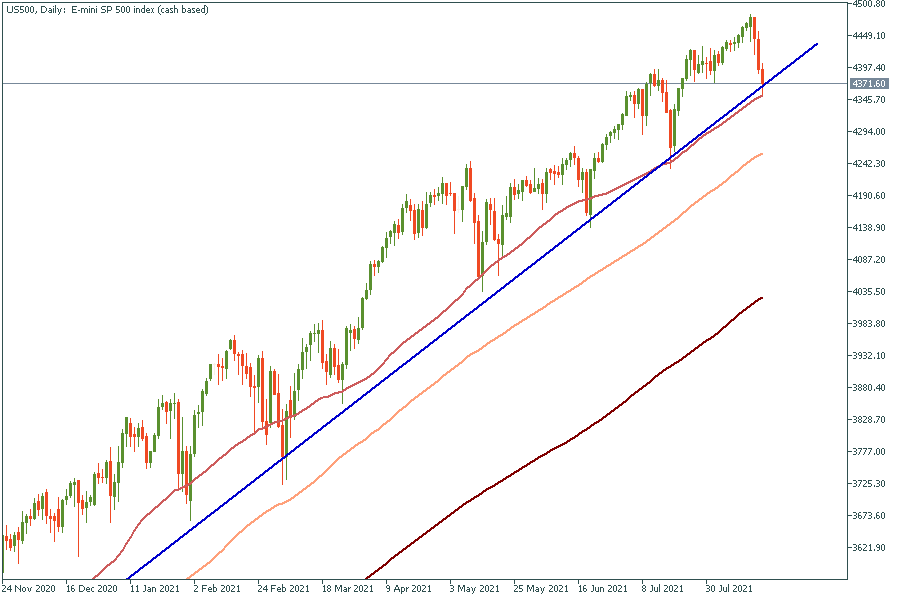

The latest minutes of the Federal Reserve’s meeting showed most Fed officials agreed they could start slowing the pace of bond purchases later this year given the progress made toward inflation and employment goals. That brought a lot of fear to the markets as S&P500 dropped to the bottom of the rising channel and NASDAQ fell to the 50-day moving average. Today traders await

the release of the US unemployment claims and Philly Fed Manufacturing Index.

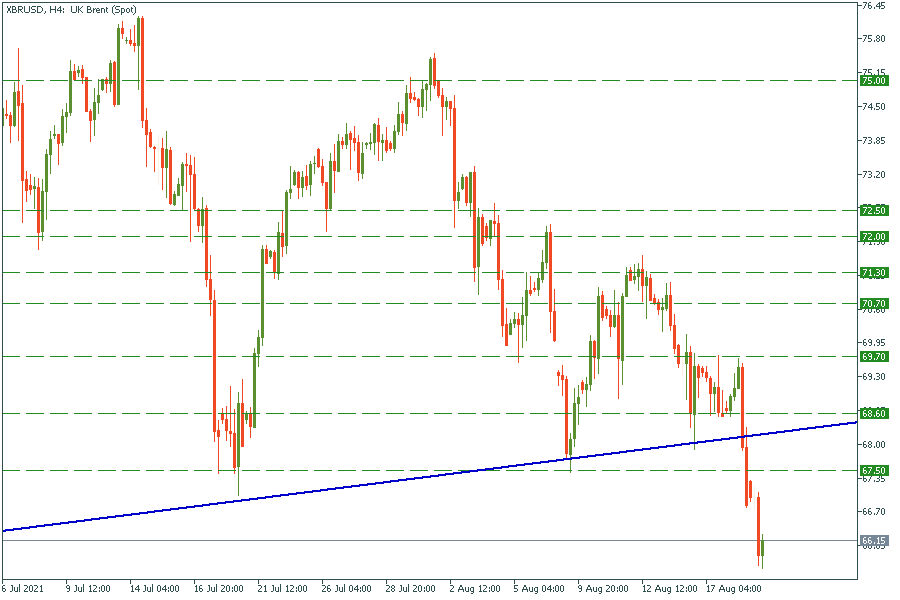

Let’s start with Brent as oil is the main markets’ driving force.

Brent, 4H chart

Brent broke through the support line which used to hold it since May 2021. As usually happens, when price breaks through the massive level it returns and tests it once again. That’s why we assume Brent to return in the $68-69 range.

US500, Daily chart

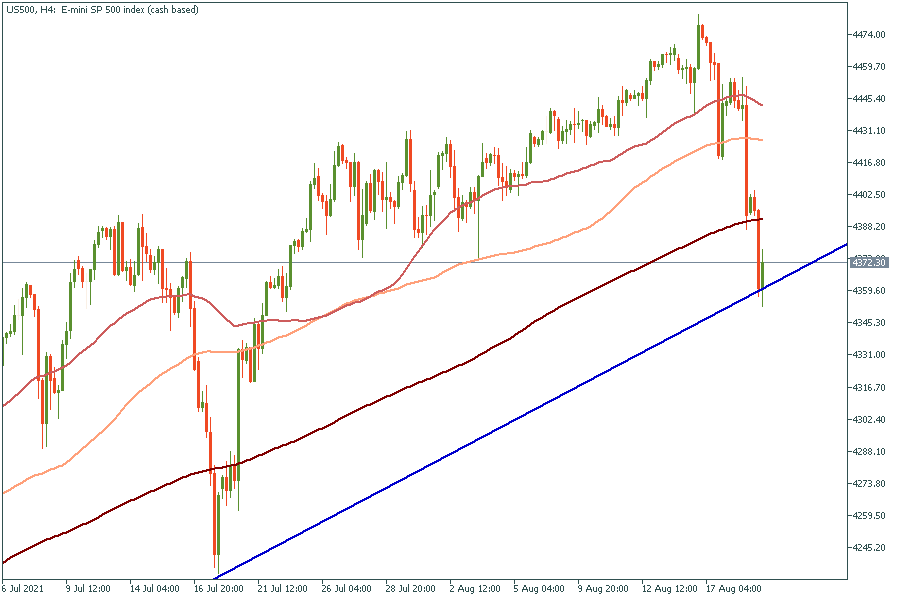

US500, 4H chart

It is important to watch both assets, as changes in oil price tell us about the perspectives of economic recovery. It might be a good time to open US500 short trade as soon as Brent reaches the support line for a retest. Until then, it is a long trade opportunity.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

After creating record highs, Wall Street's main indexes opened on Wednesday and began to edge lower, reflecting cautious sentiment among investors. They're eagerly awaiting crucial inflation data that could impact the U.S. Federal Reserve's interest rate decisions. The upcoming release of the personal consumption expenditures (PCE) price index is expected...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!