Why? Despite the fact that analysts and experts have been predicting the US stock market crash during pash year S&P500 doubled since March 2020 crush and NASDAQ is also gaining permanently…

2021-04-12 • Updated

Coca-Cola reports its quarterly earnings for the first quarter of 2021 on April 19, 12:30 MT time.

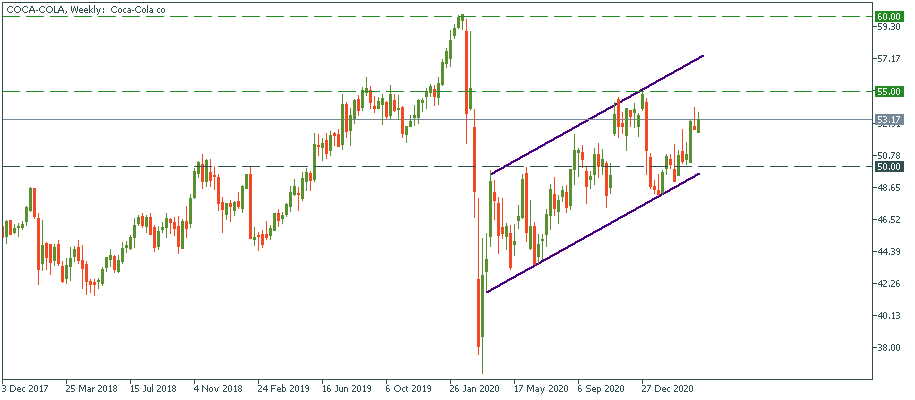

Coca-Cola’s stock hasn’t recovered from the virus hit. From the current level it trades at, it has more than 10% of potential value growth to surpass its last all-time high of $60. Will it make it? Let’s look at the fundamentals.

Don't forget Coca-Cola stock is available in FBS Trader!

Strategically, the main factor on the side of Coca-Cola is its history-proven robustness and vastness of the business. It has survived 135 years in operation, and will likely survive as much. Therefore, for long-term trading, it’s ideal. Now, what about the mid-term and short-term – perspectives that are most useful to trade the coming quarterly report?

In 2019, there was an indication of a very strong demand for the company products that pushed its sales 6%. In 2020, as most of the revenue used to come from outside venues that got closed under virus restrictions, sales fell 9%. The first quarter of 2021, however, is when the reopening process started unrolling in most parts of the globe. Therefore, while it’s pretty difficult to predict that the actuals figures will be for Q1’2021, they will be very indicative of the dynamic that may set the trend for the entire year.

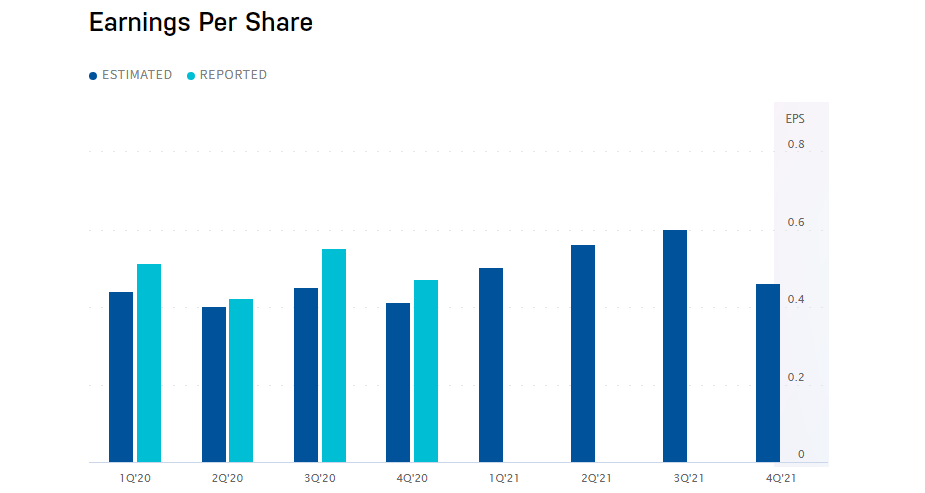

So far, Coca-Cola’s dividend yield is 3.2% which is way more than the S&P 500’s 1.5%. During the entire 2020, it's been consistently beating the EPS expectations against all odds of the virus-torn business environment. The expected EPS for Q1'2021 is $0.5.

Source: nasdaq.com

During the previous quarter’s earnings report, Coca-Cola's CFO expressed confidence that the performance of 2021 will be equally good or stronger than that of 2019. That makes the stock price of $60 adn the EPS of $0.5 a very achievable target - if the report confirms that statement and possibly beats the market’s expectations.

Why? Despite the fact that analysts and experts have been predicting the US stock market crash during pash year S&P500 doubled since March 2020 crush and NASDAQ is also gaining permanently…

About PayPal PayPal is an electronic commerce company that facilitates payments between parties through online transfers…

Where is it used? Aluminum is used in the metallurgical industry in the production of many metals…

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!