What happened?

Intel has changed its strategy and started flooding the market chips at discount pricing, rather than sticking to the manufacturer's suggested retail price. While some reports point toward a relative normalization of AMD's CPU supply after the pandemic, AMD has two distinct disadvantages compared with Intel. It has fewer revenue sources than its much bigger CPU rival, and AMD doesn't own the factories that produce its market-turning Zen chips.

Intel, on the other hand, has impressive vertical production integration and revenue advantage. These factors allow it to conduct a more flexible pricing policy.

AMD has seemingly been making strides in server market penetration. However, limited supply left many companies without their chips, that’s why Intel entered the game and made its chips more attractive for consumers.

Technical analyses

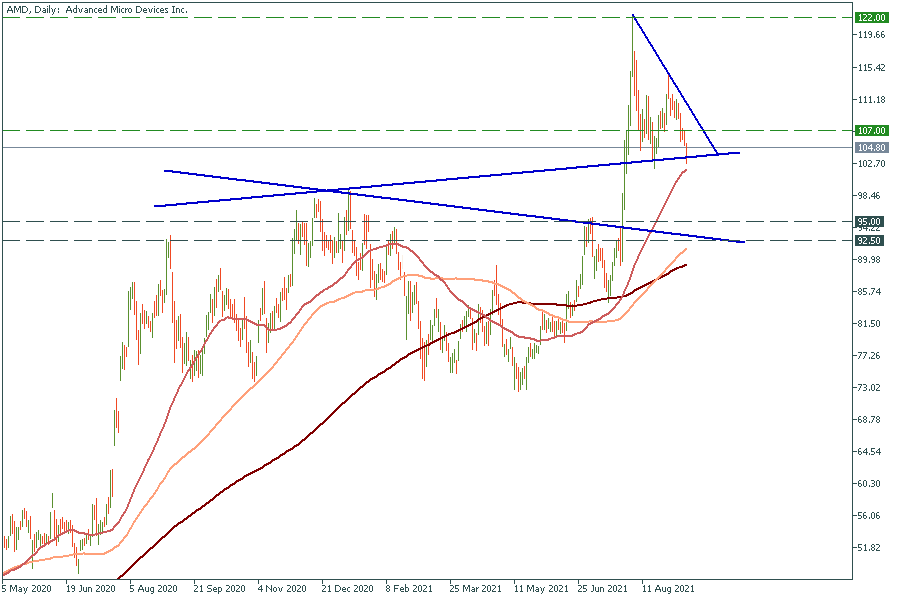

AMD, Daily chart

AMD price holds by the hidden support line at $101-$102 price level. If it breaks down through this line and the 50-day moving average the way down to $95 will be open. Otherwise, watch carefully this declining trendline and enter a long trade on its breakout, in this case, the target will be $122.

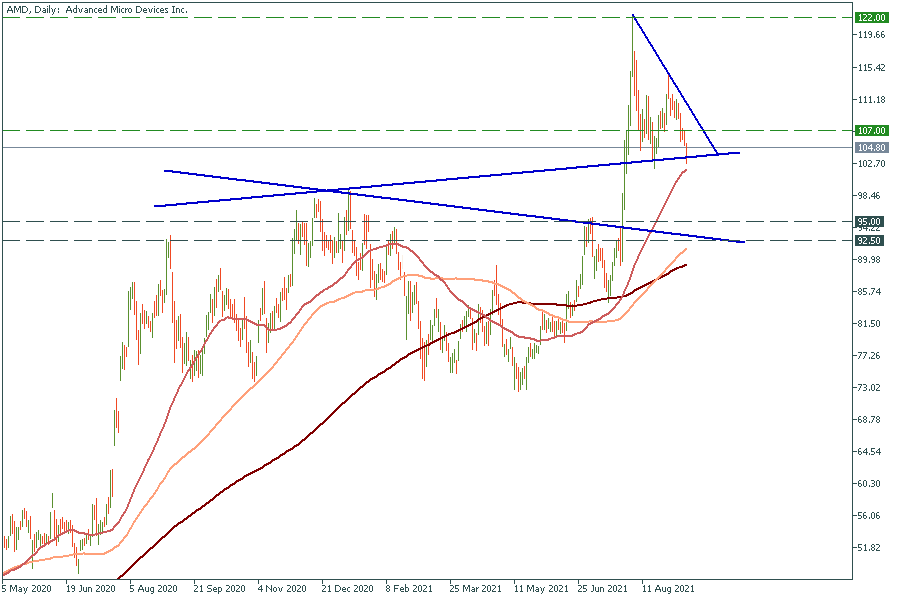

Intel, Daily chart

On the daily chart, the inverted head with shoulders pattern appeared and the price broke through the shoulder line (blue line on the chart). At the moment it is getting down to $54.3 to retest this line. If it holds above the target will be at $56.5, otherwise, Intel will drop down to $51.8.

Also, I would like to mention that in the conjuncture of NASDAQ overbought, it is risky to open long trades in technological companies, that’s why I suggest you wait until the price breaks through the $51.8 support level and open short trade with a $44.2 target.

TRADE NOW