The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

2019-11-11 • Updated

It’s not a surprise that the Brexit remains the main driver of the GBP. A plenty of negative news related to the Brexit deal made the pound’s movement uncertain this week.

The White Paper was the core of the negative news.

Last Friday the UK Cabinet agreed on the White Paper that offers a new plan on the UK’s exit from the EU. The market was calmed with prospects of the soon solution of the exit issue that let the pound to end the last week at good levels. However, not all government members agreed with the new proposals. As a result, a series of resignations shocked the market this week. Brexit negotiator David Davis and Foreign Secretary Boris Johnson, who were for the stricter Brexit program, resigned. Moreover, a great risk of the acting PM Mrs. May resignation appeared. A possibility of a vote of no confidence for Theresa May is in the arena. It seemed like the government was being ruined. As a result, the pound reacted with a fall.

On Thursday, July 12, the White Paper was finally published. The main idea of it is an ensuring of a trade cooperation, with no hard border for Northern Ireland, and global trade deals for the UK. Now the UK will look for the decision of the EU whether it will agree on the new UK exit plan or it will find contradictions.

Does it mean that risks have passed? Absolutely not.

Analysts are not optimistic about the future movements. According to them, the pound is currently overvalued and risks to the pound are underestimated. The market anticipates a soon rate hike that will support the British pound. However, in times of such a high instability, the possibility of a rate hike is questionable.

Moreover, risks of the Brexit deadlock still exist. If the European Union rejects the new plan or expresses doubts on a soon agreement, the UK Government will meet the deadend again. Although up to date, the market considers the possibility of the Mrs. May resignation as more unlikely, then the risks of it will increase. As a result, it will put additional pressure on the GBP.

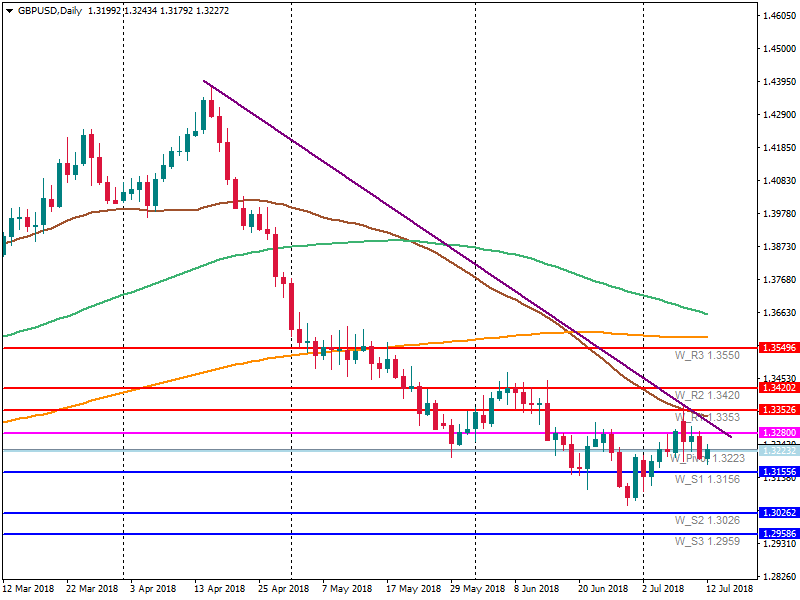

Let’s take a closer look at the technical side.

This week GBP/USD managed to reach highs of the middle of June near 1.3355. However, Brexit uncertainties cooled its rise. Up to now, the pair has been recovering, trading near the resistance at 1.3225. On the weekly chart, MAs are moving in the horizontal direction that is the signal of the smooth trading without great moves. Key levels for the near-term are resistances at 1.3280 (trendline) and 1.3355 (50-day MA); supports are at 1.3155 and 1.3025. The Brexit news will determine the further direction of the GBP. If there is a progress on the deal, the pound will move up, otherwise, negative forecasts will become real.

To conclude, we can say that in the short-term, the pound may stay at good levels as the British currency is supported by positive economic data. But in the longer term, the Brexit deal will continue to create a high volatility of the GBP. If the EU and the UK are not able to make an agreement, the pound’s fall won’t be a surprise.

The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

Yes, oil prices are burning right now, and inflation is getting hotter along with it worldwide. However, the oil's bullish momentum is under threat.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!