A quick take

As you can see, two days separate these headlines; and yet, they stand in direct contradiction. What’s on the table in the US oil sector and how may it affect the oil price?

A thorough look

One of the signature characteristics of the Biden presidency plan is environmental care. The US President said he wanted to make the US carbon-free by 2050. To achieve that, he’d need to transition the US economy from fossil fuels to other energy resources. That would require the US re-joining the Paris accord in the first place (to be re-affirmed on April 22 during the Earth Day meetings). Here are some of the central implications discussed in the media now.

- The US oil industry lives on a huge labor force. That’s why thousands of regular workers worry that Joe Biden’s plan may cost them their jobs. The US President’s administration responds that thousands more will be created in the course of the clean energy initiative so the contraction of the oil industry labor market will be by far set off by the expansion of the labor market of alternative industries.

- Under ex-President Donald Trump, the US became import-independent in oil consumption. However, Joe Biden’s plan may reverse it because the scaling down and gradual contraction of the US oil industry would be inevitable. As a result, the US may become dependent on oil-producing states again – at least, while it’s making its way to oil-free functioning in 2050.

- Even if the US completes the plan the best way possible and becomes 100% carbon-free at no cost, the rest of the world (with minor exceptions such as Europe) will keep going with oil for decades ahead. Specifically, 90% of the world’s carbon emission comes from outside the US. Therefore, while Joe Biden hopes to fight global climate change, the US cannot do that alone.

An oil trader’s look

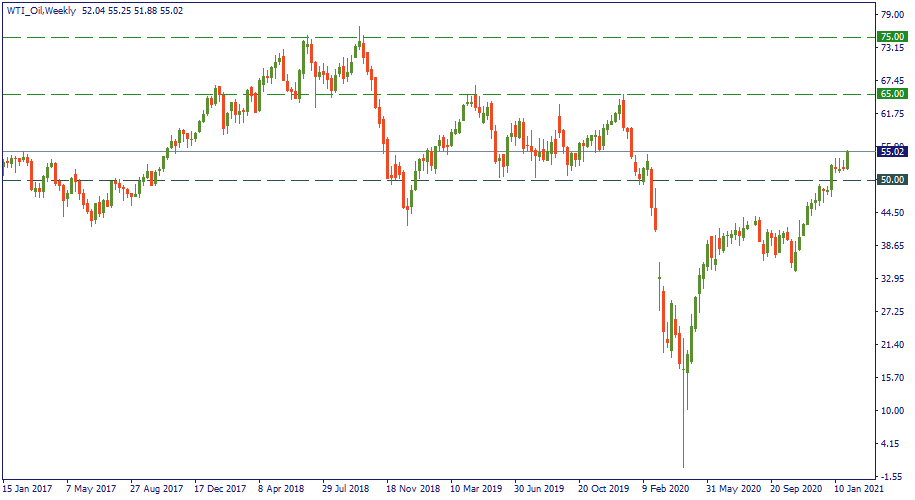

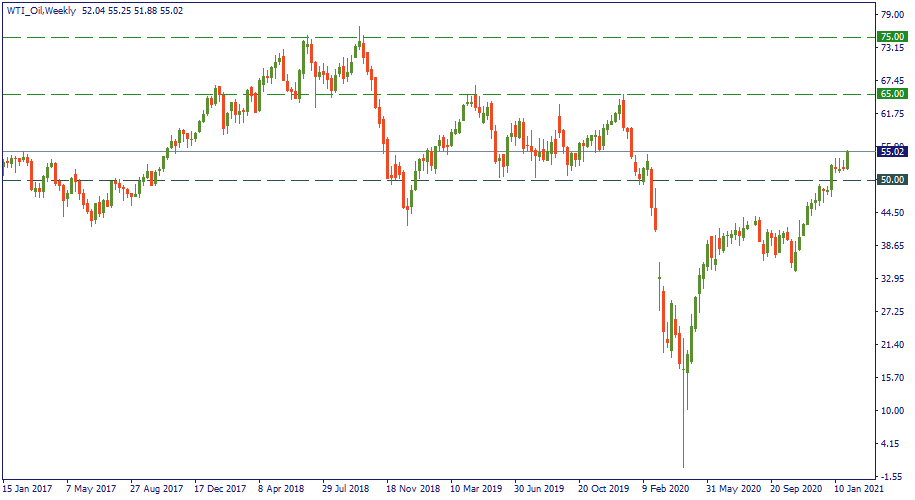

As far as the oil market is concerned, the smaller the input of the US oil industry to the global market, the higher the price of oil will theoretically be. In this sense, OPEC may be very much interested in Joe Biden’s green economy efforts as it may not only give room to the cartel’s expansion but may push the oil price, too. However, in the long-run, this process will not go without much fluctuation on the way because if Joe Biden makes the American industry carbon-free. It will eventually need less oil than before. Hence, the global oil demand is expected to suffer from this side. Nevertheless, through 2021, the channel between $55 and $65 appears to be the mainland for the WTI oil price performance. $75 may also be approached by the price in case the uptrend of 2017-2018 repeats itself in the coming 12 months.

Oil CFDs are available on FBS Trader