Reserve Bank of New Zealand will likely deliver up to two interest rate hikes before the end of the year and many more news!

2019-11-11 • Updated

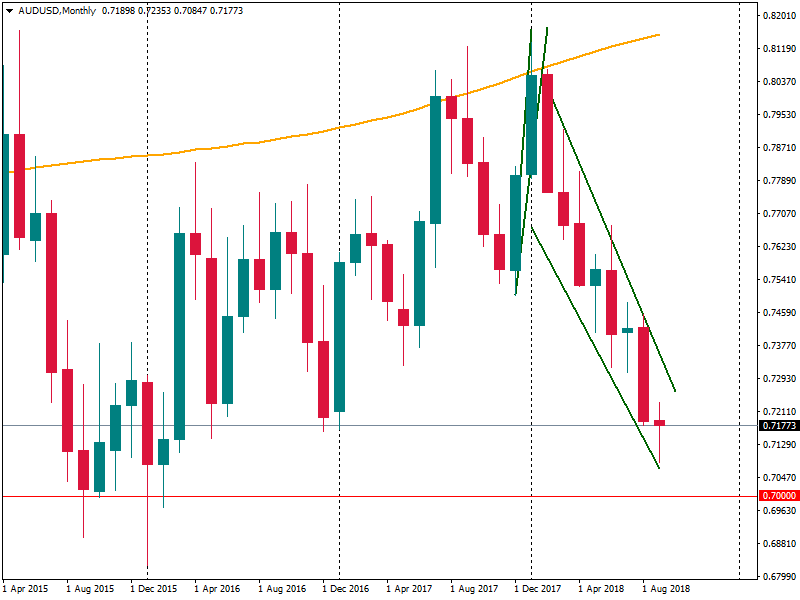

The Australian currency keeps following the negative trend as a result of the market’s contagion by trade wars. According to BNY Mellon analysts, Aussie is awaiting the final decision about tariffs on the $200 billion of Chinese exports to the US. However, the forecasts are not optimistic. Australia, which is China’s close trade partner, has been affected by Trump’s trade tensions the most, even more than Europe and Mexico.

Trump plans to apply $250 billion of tariffs to China for unfair trading. A small part of these tariffs is already implemented, and, as Trump announced, another $200 billion could take place very soon. Some experts think it can happen in the middle of September and before the US midterm elections in November. Moreover, the US President has threatened that, if needed, America can think of another $267 billion of tariffs for China.

Internal situation is also uneasy for Australia. New data from the Reserve Bank of Australia (RBA) shows that the debt to income ratio of Australian households increased to 190% from 2013 till now. The reason for it lies in a large amounts of property investments done by Australians during that period. In simple terms, everyone wanted a house and got a loan to buy it. In addition, RBA stated that it would not adapt monetary policy in the near future. This made the index of consumer sentiment fall 3% from August to September.

All that matters right now for the AUD is the upcoming reaction from the Chinese side. BNY worries that Chinese authorities would neglect the tariffs giving the currency a chance to fall. This move would help China to gain the demand for its goods from Americans, but will crush the economy of Australia.

Right now the currency is coming to its lowest levels in January 2016 and there’s a possibility for it to reach its September 2015 bottoms. As for now, the key psychological boundary and a signal for bears is at 0.70. Although the currency has been trading in the green zone since the beginning of this week, the investors should operate it very carefully.

Reserve Bank of New Zealand will likely deliver up to two interest rate hikes before the end of the year and many more news!

4H Chart Daily Chart The Reserve Bank of Australia decided to keep the current policy unchanged as widely expected…

The Reserve Bank of Australia will hold a meeting on August 3. Analysts expect a dovish move, which may send the AUD down.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!