Novavax is Under Attack

Novavax tried to fulfill more than 2 billion doses of vaccine, but the campaign is now delaying too much due to production lags. Is that a sell sign for investors?

The plans were too big

Novavax (NVAX), the world’s vaccine distributor has been counting on U.S. companies to provide more than 2 billion doses to lower and middle-income countries by the end of 2022. In case of success, the company would have a crucial role in the fight with Covid-19.

But the campaign has already been delayed significantly because of production lags and is now likely to fall short by more than 1 billion doses as a key supplier faces significant hurdles in proving it can manufacture a shot that meets regulators’ quality standards.

The U.S. government invested $1.6 billion in Novavax in 2020 — the most it devoted to any vaccine maker at the time — in hopes that it would offer the world another option for a safe and effective vaccine to help protect against Covid-19. But the company has consistently run into production problems. The methods it used to test the purity of the vaccine have fallen short of regulators’ standards and the company has not been able to prove that it can produce high-quality vaccine shots.

Another big problem is that purity levels that have been set by FDA are not met by Novavax. The company only has around 70% purity in every batch of the vaccines, with requirements are at 90%.

What about the stock?

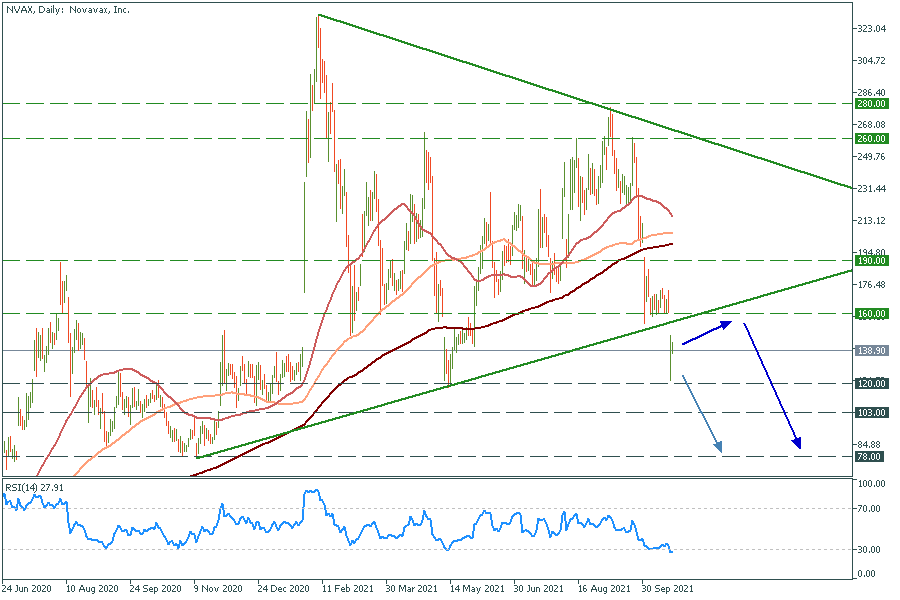

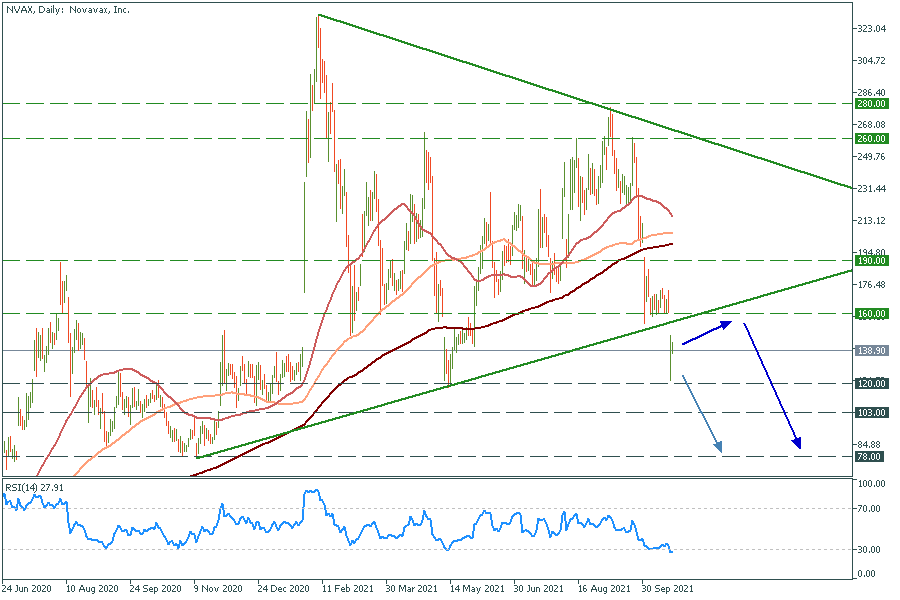

Falling by more than 50% since September 24, the price chart of the NVAX is still looking bearish. Considering given problems with vaccines production and distribution, we suppose the company to plunge even more. This means the support levels now are not the pivotal points: the price can react to them but will probably continue its downtrend. Don’t forget to take your profit on these levels.

Novavax daily chart

Support: 120.0; 103.0; 78.0

Resistance: 160.0; 190.0; 260.0