The USD index fell from 94.50 to 93.50. The currency suffers from bad political headlines. Wall Street Journal reported that the court demanded documents from President Donald Trump’s election campaign. This came as a part of investigations into possible Russian interference in the 2016 US presidential election.

Moreover, the market remains focused on the US tax reform. There’s no clarity whether the legislation can go through this year. Although US House of Representatives has approved a broad package of tax cuts this week, the main obstacles for the bill will be in the Senate. Full Senate action is expected after next week’s Thanksgiving holiday. There are many challenges ahead for the reform and this will hurt any attempts of the USD to recover.

In addition, even though the Federal Open Committee (FOMC) appears to be on course to deliver another rate-hike in December, the US economic figures aren’t too bright – another brake on the USD.

Next week there will be some important releases in America’s economic calendar. Existing home sales will be out on Tuesday, durable goods orders and the Fed meeting minutes will be released on Wednesday. The Fed chair Janet Yellen will make a speech, although the market started to pay less attention to her as her term is close to an end. On Thursday the US will celebrate Thanksgiving Day, so it will be a bank holiday.

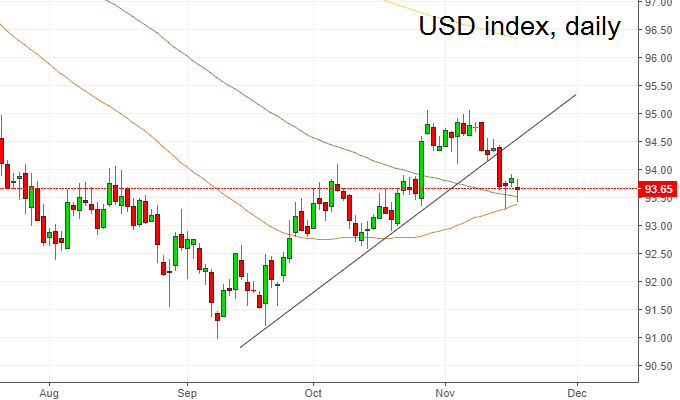

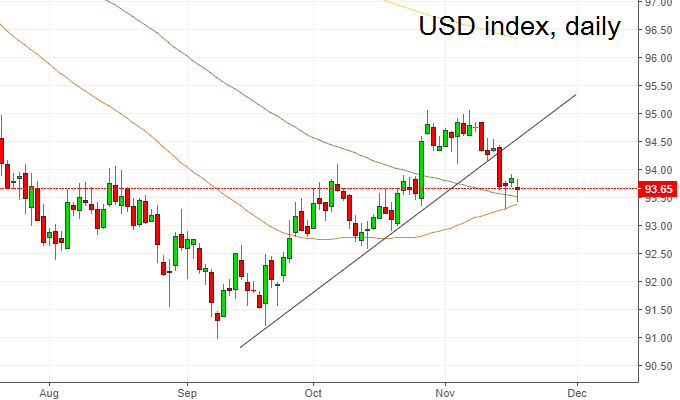

The USD index violated September-October support line. This line turned into resistance in 94.25 area. Next obstacle for bulls will be at 94.50. At the same, 100-day and 50-day MAs provide the greenback with support in the 93.50/40 zone. The second line is about to get above the first one – this is a bullish sign. In addition, 200-week MA is located at 93.30. It won’t be very easy for bears to quickly pull the USD below this level.