Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-11-24 • Updated

This currency pair is definitely going through fierce fluctuation. The recent rise to 1.19 followed by a plunge to 1.18 and correction confirms that. Now, EUR/USD is back at 1.1850 – that’s the downside of the core channel it’s been going through. That means it makes sense to expect it to gradually move to the upside closer to 1.19 – step in!

Hopes of having Brexit sealed this week are pushing the GBP. This currency pair has moved from 1.3210 to 1.34 in the recent spectacular upswing. Undoing this overheated gain, GBP/USD got back down to 1.33 to start climbing again. It’s only rational to prepare for another gradual uptrend to 1.34. Welcome aboard!

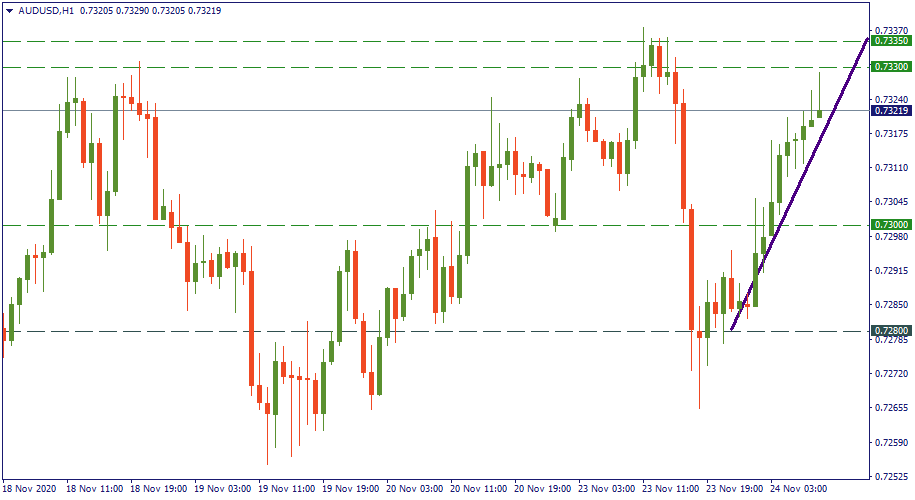

The resistance range of 0.7330-0.7335 seems to be impregnable for AUD/USD so far. The currency pair touched it several times in November bouncing downwards – just as it did this Monday already. Expect this resistance to be reached in the short-term and possibly reverse the currency pair downwards yet again.

After the first week of November, 1.3040 has been preventing USD/CAD from dropping below. We can see it bounce upwards several times on the hourly chart below. Possibly, this is another reversal we are observing right now. This makes it potentially an ideal opportunity to use the situation in the short-term. Watch it get back up to 1.31!

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!