Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

2020-11-25 • Updated

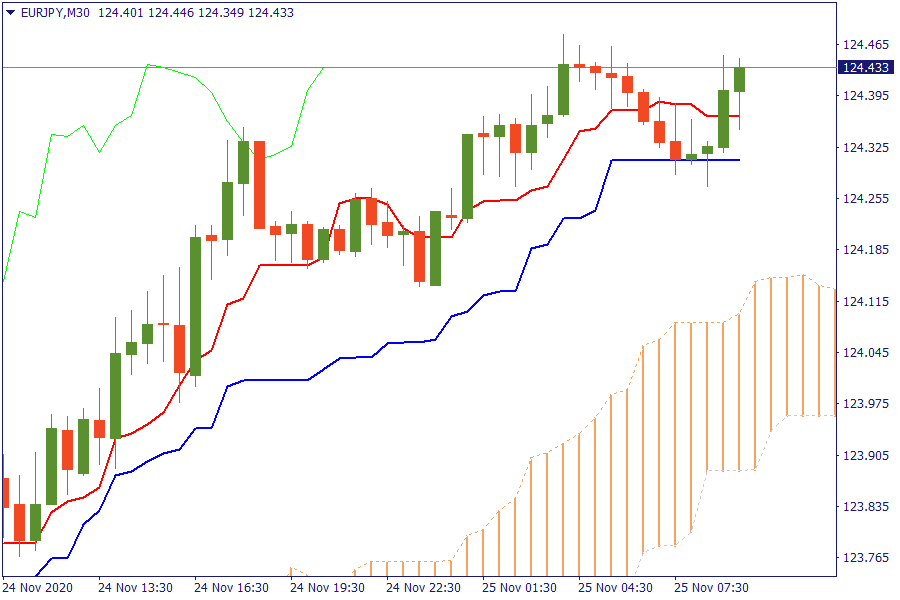

EUR/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook.

XAU/USD: Gold has broken down all the retracements areas, which warns of further weakness.

Most major Asian equity markets traded positively as the region took impetus from the record-setting session in the US where the S&P 500 notched a record close. US Treasury Secretary Mnuchin said he will place the USD 455bln of unspent CARES Act money in a general fund, which would need congressional approval to be utilized. Looking ahead, highlights from the macroeconomic calendar include US Durable Goods, GDP (2nd), Core PCE Prelim, University of Michigan Survey, ECB Financial Stability Review, UK Chancellor Sunak November Update, FOMC Minutes.

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Earnings season is a crucial time for investors and analysts, as it provides insights into how well companies have performed over the past quarter and gives indications of their future earnings. In 2023, expectations for US Q1 earnings were low due to economic challenges and rising interest rates. Surprisingly, many companies beat these low expectations, with 75% of S&P 500 companies surpassing forecasts.

When I started trading stocks a few years ago, I often needed to pay more attention to my technical analysis skills and trust that the market would play fair according to my analysis. I have since discovered that the safer approach to trading stocks is to, more often than not, seek out investing opportunities - that is, catching stock commodities with a potential to rise.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!