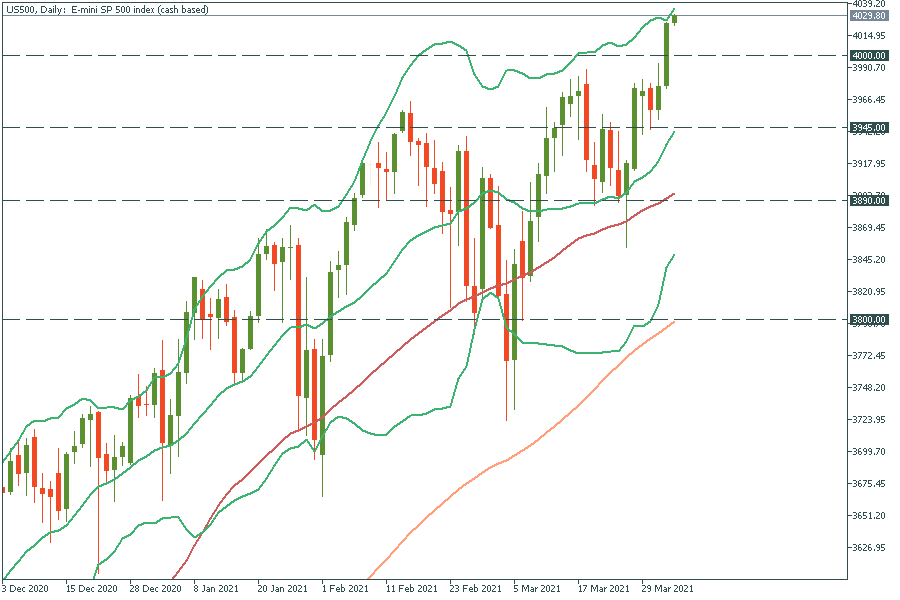

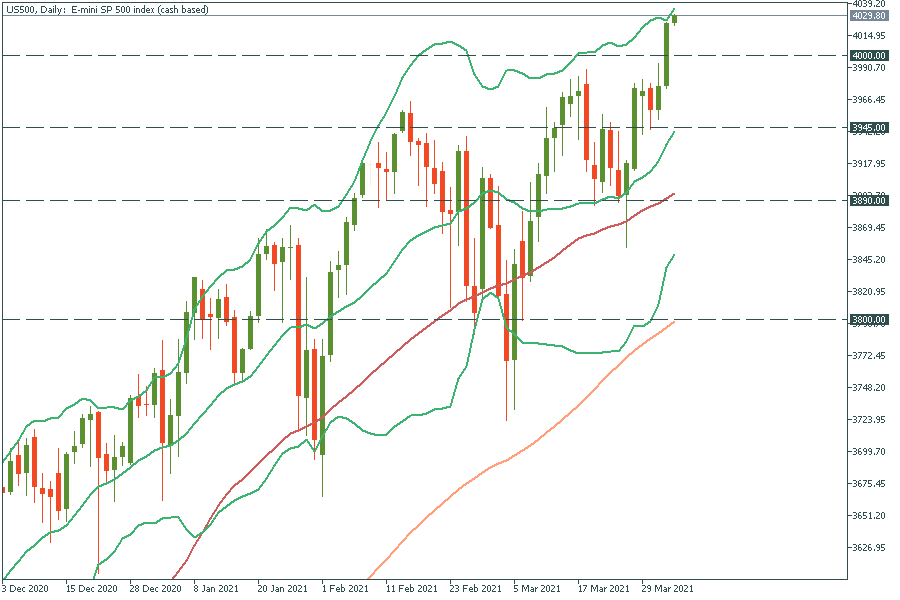

S&P 500 is trading just below the key milestone of 4000. It’s likely to hit this level by the end of this week. What is the reason for this growth and what is the forecast? Let’s find out!

Biden’s infrastructure plan

Stocks were mixed on Wednesday as Biden announced its $2.25 trillion infrastructure plan to offset the corporate tax increase from 21% to 28%. The US President said this tax hike would bring $2 trillion over 15 years. However, some Democrats are still able to cut the increase to less than 28%.

Unlike Nasdaq’s big jump, S&P 500’s growth was modest. This huge plan includes $620 billion in spending on transportation, including electric-vehicle incentives, and $500 billion – on growing the domestic manufacturing sector, with a focus on the chip industry and green manufacturing.

Thus, it has a greater impact on the tech Nasdaq than S&P 500. However, the overall effect was taken positively by investors as the US economy will recover faster with the government’s help. On the other hand, the tax hike is a negative factor for stocks.

Best month since November

March was the best month for S&P 500 since November and their fourth positive month in five! It gained more than 4%.

Bullish forecasts

Sanford C. Bernstein strategists projected S&P 500 at 8000 in 100 months (eight and a half years). Let’s wait and see!

Technical analysis

S&P 500 (US 500) has been rising and rising without any stops since the coronavirus hit the markets in late February of the last year. It has broken through the key psychological mark of 4000. The way up to 4050 is open now. If it manages to break it, it may jump higher to the next round number of 4100. However, as we can notice, the upper line of Bollinger Bands lies just above the current price, indicating the price is too high. Besides, after the price breaks such significant resistance levels, it usually retraces back. It’s a so-called natural sell-off, after which the price will continue rising. However, if bulls keep momentum the rally up will continue without any stops. Just in case, support levels are 4000 and 3945.

Important! The trading of stock indices will be close today at 16:00 MT because of the Easter holidays.

TRADE NOW