The Hateful Eight: Meet the Most Infamous Villains of Finance

So this is the world of finance. The place where money is made. Like, big money. This is the big game world, the world that has brought us quite a few masterminds. Alas, not all financial prodigies use their money-making talents with good intent.

The likes of Bernie Madoff, Joseph Nacchio, Michael de Guzman, Elizabeth Holmes, or the Wolf of Wall Street himself – Jordan Belfort used their knowledge, skills, acquaintances, or whatever they had to make huge amounts of money by – should we put it straight – defrauding people.

The world is your oyster, they say. But for the baddies of finance, the world is their scheme.

All the world’s a scheme

A financial scheme, or a money scam, is a malign act by which a fraudster gets access to a victim’s funds. It is important to stress that a victim gives their money voluntarily. “Why?” you would ask. Because that’s what fraudsters do best: they convince people.

Scammers come up with schemes that seem legit, and they promise big and quick profits. They make offers hard to resist, at least for those who end up losing their funds eventually.

Frauds can be hard to tell. However, as you break down those schemes, you start seeing standard features that may help you run a personal check. Here’s what you should pay attention to:

- Guaranties of high returns in a short time.

- Invitation to join an exclusive or elite group of investors.

- Claims that an offer comes from someone who works “inside.

- Claims of some sort of technology that is bound to change the game in the nearest future.

- The overall image of an offer too good to be true.

That’s just to name a few. In reality, there can be more features, but eventually, they come to this simple set of lies. The bottom line is that a fraudster would use some of these lies to lull your

conscience and make you invest in a quote-unquote promising venture.

People have been falling for money scams for centuries now. One of the earliest examples of stock fraud goes back to the 1700s. Just google the “South Sea bubble.” It was one of the most prominent cases of what is now known as the pump-and-dump scheme.

A fraudster would first boost the stock price by giving false information about the company, and then, when the price is high enough, they would dump the hyped shares into the market. As a result, you lose your money because stocks are really worthless, so when the hype is gone.

You can see how this works in the Boiler Room, a crime drama from the late nineties. Or you can check out Jordan Belfort’s story for a real-life example. The movie was made about him, as well. However, pump-and-dump is, of course, not the only way to get you separated from your money. In fact, there are plenty of them, including some of the most frequent:

- Promissory note frauds.

- Affinity group frauds.

- Binary investment scams.

- Advance fee frauds.

- Various types of internet fraud.

- Investment seminars.

Yep, some of these are too considered frauds. But the most popular scheme is, of course, the pyramid.

Pyramids are genius in their simplicity. It recruits an ever-growing number of investors, each new investor recruiting new people into the venture. Those new clients look for other investors to recruit, and so on.

Pyramids can grow for years and even decades, but they do terrible damage as they tumble down. And it’s just about time I gave you the list of the most prominent pyramids so far, but here’s where it gets controversial. Most pyramid-like ventures are officially presented as multi-level marketing. And that is a legitimate business strategy. Being given a pyramid status takes a court decision.

So even with so many companies publicly referred to as pyramids, for the sake of good manners, we will not call any of these multi-level marketing corporations a fraud.

However, what is truly a fraud is a scheme that looks pretty similar to a pyramid – the Ponzi scheme. Named after Charles Ponzi, a fraudster in the 1920s, this scheme recruits new investors by promising high returns. With this scheme, early investors get paid with funds from later investors. The scam lingers until the majority of investors choose to demand returns. When that happens, the Ponzi scheme disintegrates.

The world of finance has seen multiple stories of fraudulent money-making. In this post, you will learn about the world’s eight biggest stock market frauds and the masterminds behind them.

The Top 8 market scams and scandals

Bernie Madoff

We’ll start with a classic example of the biggest Ponzi schemes ever.

Bernie Madoff, a New York financier, used his reputation to recruit new investors as he promised them steady, double-digit returns. While the investors thought they were buying stocks, in reality, Madoff deposited their money in his bank account.

He used some of that money to pay the requested funds as promised returns. The whole thing worked for more than a decade. Again, it was possible due to Madoff’s public image as a respectable and trustworthy businessman. After all, he was the man behind NASDAQ.

But, sooner or later, all things must end. Bernie Madoff’s fraud dissolved after the infamous 2008 crisis. That was when most of Madoff’s clients wanted to pull their money out. And as you know it, no Ponzi scheme can ever survive that.

When the fraud was exposed, Madoff faced severe charges. And the verdict said he was about to spend the rest of his life behind bars. His sentence was 150 years. Bernard Lawrence Madoff died in prison on April 14, 2021. Sadly, it was not the only death related to this fraud.

Two years after Madoff’s exposure, one of his sons and business partners committed suicide, just as several of his investors did.

How much did Bernie Madoff steal? The official numbers say 65 billion dollars, and that’s just insane. For how long did the scheme exist? That is a tricky question. You see, Madoff himself testified that he started his scheme in the early 90s.

Frank DiPascali, an account manager, who had been working with Madoff since 1975, said the fraud had been in process since he remembered. But the documents discovered during the investigation show that Madoff had been pulling off the scam since the early 1960s. Add millions of fake trade reports, and you will get the world’s largest Ponzi scheme.

Jordan Belfort

You may know this name from Martin Scorcese’s “The Wolf of Wall Street”. However, if you thought that flick was nothing but fiction, you got it wrong. Jordan Belfort is a real person, and much of what you saw in the movie was kind of true.

Belfort used market manipulation for his long-running scam, which was often referred to as a pump-and-dump scheme. He teamed up with a bunch of ambitious brokers to found Stratton Oakmont, Inc.. This "over-the-counter" brokerage house would years later become infamous at the backdrop of Belfort’s and his several partners' arrests.

The scheme was nothing new, really – Belfort and his brokers would drive up the stock price so that later they would cash out, causing the stock to plunge drastically in value. Hundreds of ambitious brokers worked in Belfort’s wolfpack, cold-calling unsuspecting victims and persuading them to buy worthless stocks.

The story ends in 1998 with a total loss of $200 million. Belfort got indicted for securities fraud and money laundering, making it into The Wall Street crimes list.

Michael de Guzman

Here’s another infamous fraud with a movie based on it. But before we get to a film starring Matthew McConaughey himself, let’s talk about the actual story.

The year is 1993. Michael de Guzman, an employee of Bre-X Minerals, claims there’s gold in the jungles of Borneo. From that moment on, a sort of gold rush kicks off, which involves Bre-X Mineral’s stock skyrocketing to the value of $6 billion!

It all happened between 1993 and 1996, with Michael de Guzman promptly producing fake gold samples from the Borneo region.

Guzman’s fraud came tumbling down after the Indonesian government became suspicious. As a result, the state revoked 45% of Bre-X’s control of the mine. Freeport McMoran, an American mining company, did much drilling but to no avail – not a single flake of gold was found. There’s no happy ending for Bre-X as its value hit rock bottom before anyone knew it.

Some of what happened made it into a movie by Stephen Gaghan. Starring Matthew McConaughey, this 2016 crime drama tells a story loosely based on the Bre-X scandal.

Joseph Nacchio

This story is one of the most famous insider trading scams that resulted in an impressive $3 billion loss.

What is insider trading? Simply put, it’s a fraudulent scheme of selling stock one knows for sure will plummet soon. To pull that off, one must be well aware of the market situation or the processes inside a certain company, hence the term insider trading.

Joseph Nacchio is one of the world’s greatest stock insider traders. As the CEO of Qwest Communications International, Nacchio persuaded Wall Street to buy Qwest stock, saying that the company was about to make a huge leap forward. However, in reality, Naccio knew that none of it was true.

Convicted on 19 of 42 counts of insider trading, Nacchio was then sentenced to six years in federal prison and was also ordered to return $52 million he had earned during illegal stock trading.

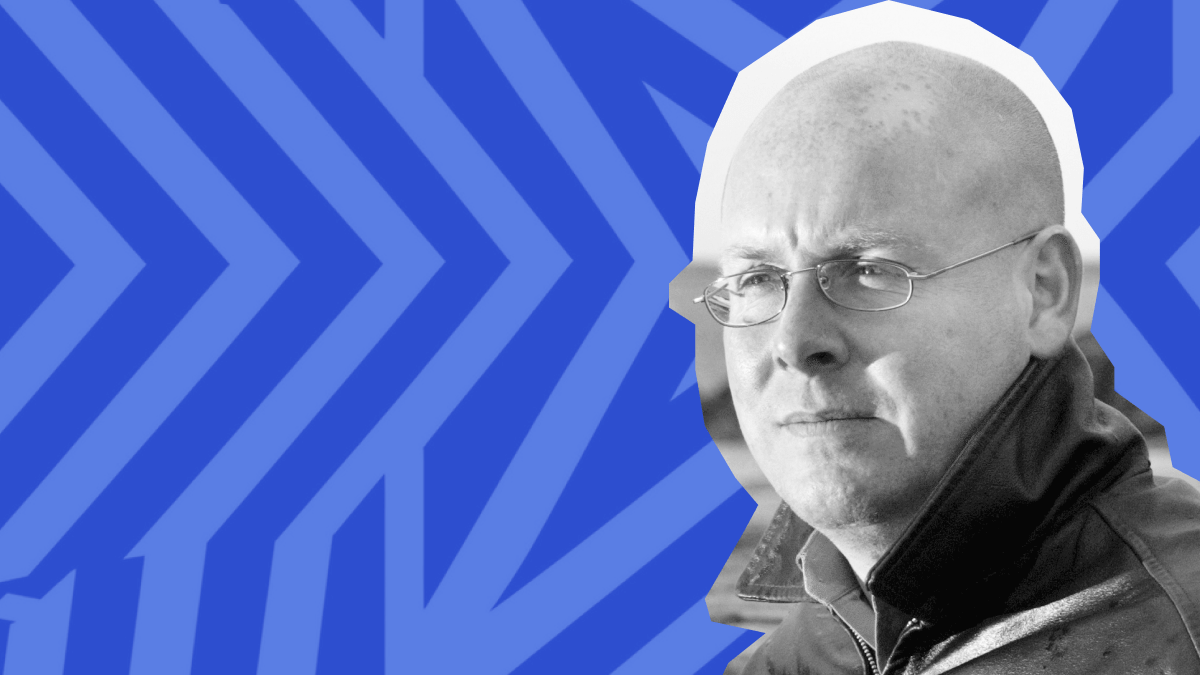

Nick Leeson

Miss any movies yet? Here’s another one called “Rogue Trader,” and, guess what, it’s also based on a true story, the story of Nicholas William Leeson, a former derivatives trader from England.

Portrayed by Ewan McGregor in a 1999 drama, real-life Barings Bank employee Nick Leeson used a so-called error account covering his and some of his fellow traders' bad trades. The whole thing began when Leeson had to cover a string of mistakes made by his colleagues who would frequently party hard. The practice eventually led to a $1.7 million loss.

As Leeson later said, he only wanted to keep his job, so he used the error account to hide such a massive error. Also, Leeson insisted that he never used this scheme for personal gain. However, in 1996, it was revealed that various bank accounts with a total amount of $35 million were tied to him.

After a series of Leeson’s grave mistakes in 1995, Barings Bank lost £827 million and was soon declared insolvent. Leeson tried to escape justice but was apprehended and extradited to Singapore.

Convicted to six and a half years, Nick Leeson was released in 1999 for good behavior and health conditions – he was diagnosed with colon cancer. However, Leeson was lucky to survive the disease.

As of today, Nick Leeson is still into trading. But now he uses his own money.

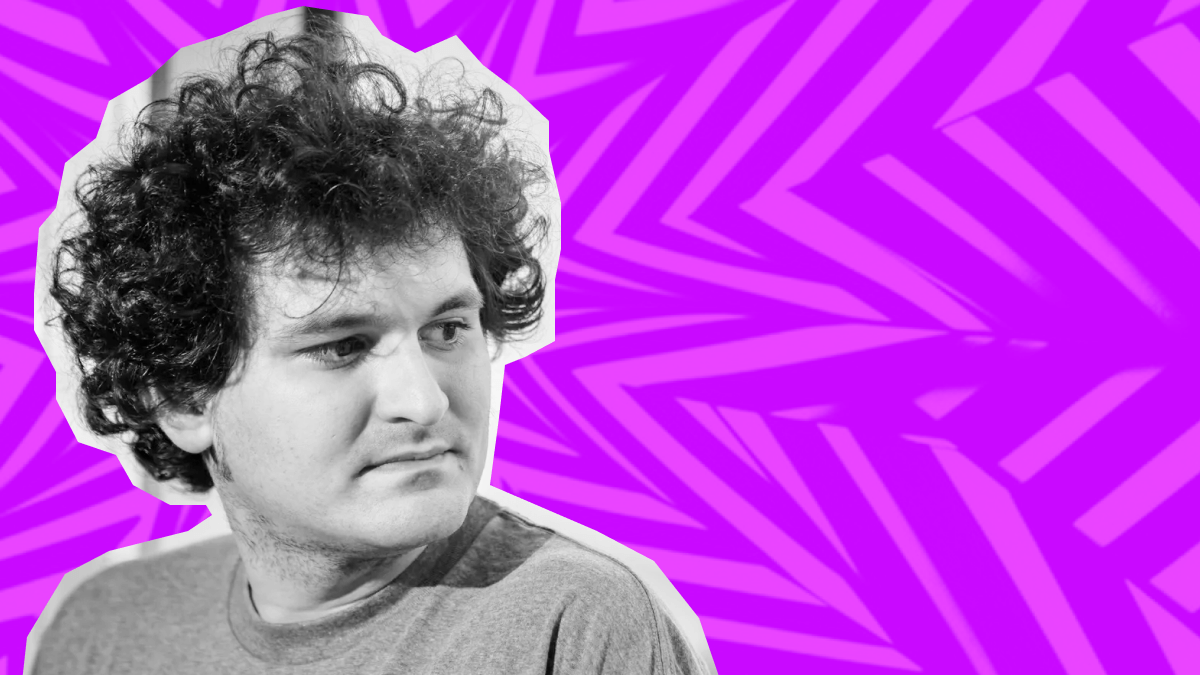

Sam Bankman-Fried

Sam Bankman-Fried’s story is the most recent one and the most resonant as well. As the FTX scandal, as many think, may have long-term effects on the whole crypto industry.

FTX Trading Ltd. is a former cryptocurrency exchange and hedge fund founded by Sam Bankman-Fried and his partner Gary Wang in 2019. In 2021, the company was at its peak with over one million users, making it number three on the top cryptocurrency exchange list.

The trouble began in 2022. It was revealed that Alameda Research, another company founded and run by Bankman-Fried, held an impressive position of $5 billion in FTX’s native token – FTT. Further investigation showed that Alameda’s investment foundation was also in FTT, strangely and suspiciously, not a fiat currency or any other crypto. So basically, the firm operated as a so-called market maker for FTX, pumping the value of FTT through massive purchases.

This information raised concerns among FTX investors, which then led to massive withdrawal requests of a total sum of $6 billion. First, FTX announced a liquidity crisis. Then, the company claimed that $477 million worth of FTT was stolen from it.

The unfortunate events resulted in FTX going bankrupt, Sam Bankman-Fried getting arrested, and the entire crypto industry becoming anxious about things to come. Bankman-Fried is to face trial in autumn 2023.

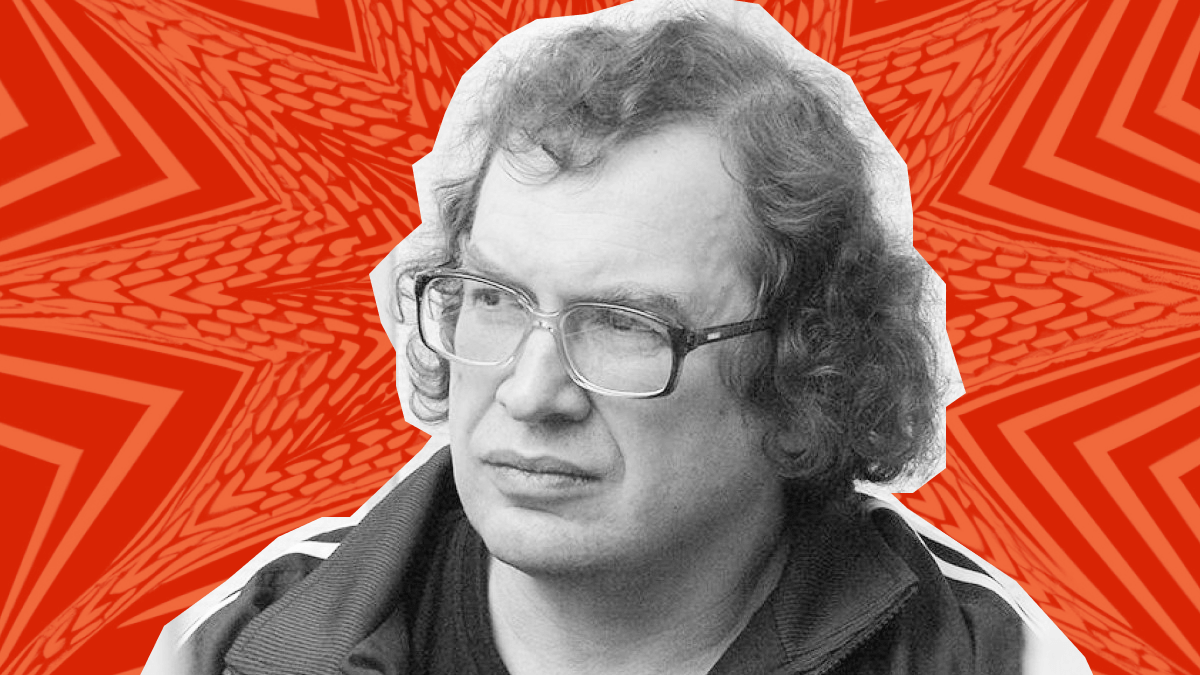

Sergei Mavrodi

Most financial scams and fraud stories come from the West, the wealthiest part of the world and the home of financial capital. However, history has a vivid example of a grand financial fraud from a country you would least expect in the context – Russia.

After the collapse of the Soviet Union, the country found itself in political and economic turmoil. The 1991 coup d'état and drastic events that followed provided a grim backdrop for the long-term effects of a neoliberal economy that dismantled what was left of the socialist legacy.

The dog-eat-dog reality of the 90s Russia bred many fraudsters who promised desperate people easy money. One of the most notorious was Sergei Mavrodi, the man behind Eastern Europe's largest financial pyramid, MMM.

MMM started in 1989 but reached its prime in early 1994 as Mavrodi launched his Ponzi scheme. With aggressive advertising on TV, MMM attracted ordinary Russian citizens with promises of impressive profits. As one of MMM’s commercial characters said, “I’m no freeloader, I’m a partner”, the idea was that a person invests in MMM with a promise to get an insane 3000% of yearly return.

As you can guess, few lucky ones ever saw such figures. The trouble began later that same year as thousands of MMM investors protested against Mavrodi’s company. Even though the fraud was blatant, there were no laws in the Russian Federation against Ponzi schemes at the time. So there was no help coming.

However, Sergei Mavrodi was accused of tax evasion. This eventually made Mavrodi flee Russia, with MMM declared bankrupt in 1997, leaving, as some resources say, nearly 10 million people empty-handed. Reportedly, fifty victims of MMM committed suicide.

Elizabeth Holmes

Have you ever heard of Theranos? If not, then you will definitely find this story entertaining. There is already a movie project for it.

Please meet Elizabeth Holmes, a young and attractive woman, a former biotechnology entrepreneur, and an officially declared fraudster. Holmes’s contradictory career as an entrepreneur started in 2003 when then-19-year-old Elizabeth founded Theranos, an innovative healthcare startup. The idea was to break new grounds of blood testing with a newly created all-in-one blood testing machine.

By the way, did we mention that Holmes dropped out of Stanford in favor of becoming a healthcare entrepreneur? Well, she did. Did this fact affect Holmes’s invention? Maybe it did. Or perhaps it’s just a small touch to Liz’s portrait. Anyway, let’s continue.

As Elizabeth built a small empire of her own, she was adamant that her brainchild would become a game-changer. Liz used her family’s connections to promote her business, get investors and seek support from the American establishment. The list of those who helped her in various ways included such personas as Henry Kissinger and then current president of the United States, Joe Biden.

But things could have gone better in terms of production. As it was later revealed, Theranos had terrible employment policies, questionable science, and shady commercial techniques. Among the biggest problems that Theranos had were unfair dismissals, unrealistic deadlines for the production team, and downright theft, as some parts of the Theranos machine were “borrowed” from medical equipment by Siemens.

To cut a long story short, the Theranos blood testing machine turned out to be a failed innovation with next to no medical use. In 2018, it was announced that the company would cease operations after being unable to find a buyer. As you may guess, the message was an unpleasant surprise for Theranos’ investors.

In 2022, Liz Holmes was convicted of defrauding investors and acquitted of defrauding patients. Thus, the Theranos story is a perfect and recent example of a fraudulent investment scheme based on a claim of technological innovation that promises investors massive returns with unfortunate zero results and heavy losses.

Conclusion

Statistics show that approximately 30 million people fall victim to financial fraud yearly. That number is insane! The stories you've learned today are just a tiny part of what happens in today's financial world. There are a lot of scammers out there who want to help you get rid of your money. And if you need one piece of advice to keep your money out of harm's way, here's one: don't fall for promises of easy money, because when you do, bad things start to happen.

When looking for investment options, try respectable brokerage companies with years of experience, clear conditions and solid reputation. FBS is one of such companies, providing means for trading, including up-to-date software, free education, and favorable conditions.