Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-06-17 • Updated

The last Monday was depressive, Tuesday changed gears later in the day, while Wednesday is cautiously positive. Most currency pairs appear to be a bit confused by this scrambled beginning of the week. Consequently, charts are showing either consolidation or slow retraces on the previous moves.

Against both the US dollar and the Japanese yen, the AUD trades at the level were local uptrend and downtrend collide. The current disposition in line with the Awesome Oscillator suggests it may slide down to touch the supporting uptrend and eventually get back up to test the downtrend marked above.

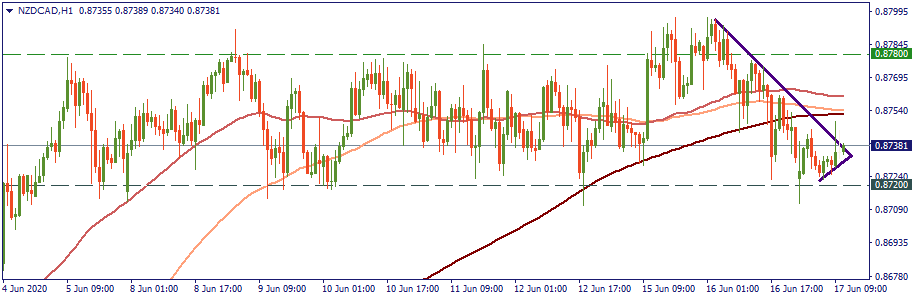

NZD/CAD is showing a pure sideways motion since the first week of June. In the last episode, it inched above the channel’s resistance of 0.8780 and slid down to its support at 0.8720. The current local uptrend suggests it may be the beginning of another bullish wave – the Moving Averages will be capping and checking this upward intention.

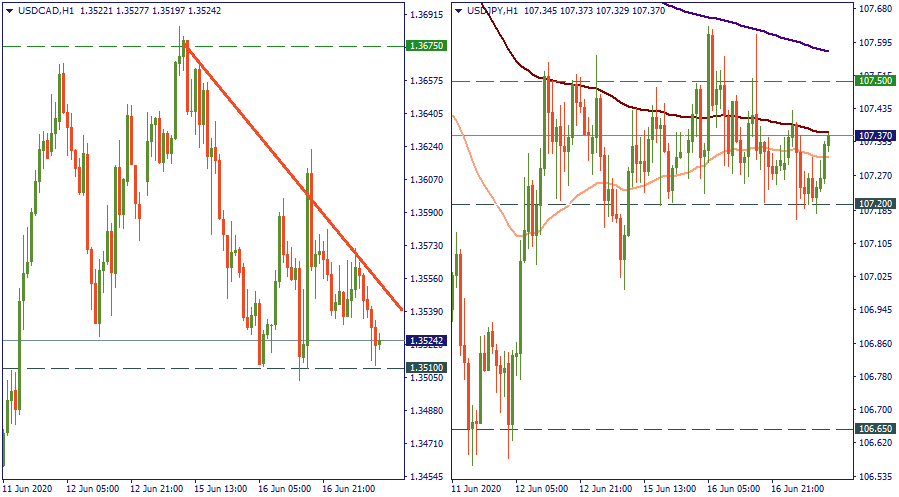

The US dollar gave up a bit of its positions against the CAD, dropping down to the local support of 1.3510 in a downtrend since last Friday. Against the JPY, it is in fluctuation in the channel between the levels 107.50 and 107.20, currently testing the resistance of the 50-MA.

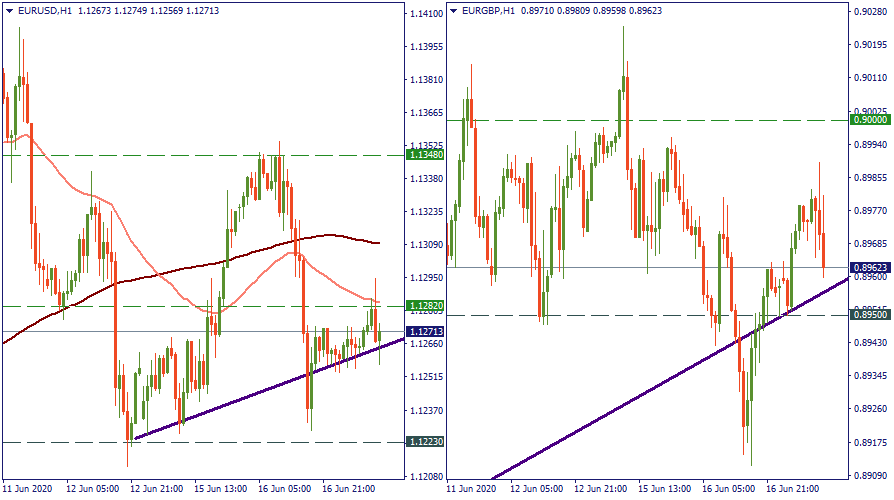

Against the USD, the EUR is crouching upwards after an undone peak at the beginning of the week. The resistance of the 50-MA at 1.1282 is being tested and will check if the current bullish push is enough to advance higher. Against the GBP, the EUR is dropping after a sharp drop on Tuesday – the bearish target lies at 0.8950.

This kind of market sentiment is pretty prone to quick changes on any income from the fundamental side. Meaning, as soon as there is any news that seems relatively important, these sluggish movements may quickly reverse or gain a higher pace. For this reason, watch the news carefully and prepare for some movement.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!