Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2021-02-02 • Updated

Qualcomm reports its quarterly earnings on Wednesday, at 23:45 MT time, with the expected EPS of $1.87.

What are we in for?

As one of the primary Apple suppliers, Qualcomm doesn’t only produce wireless chips but operates in cloud gaming and wireless car networking. It has been facing certain headwinds during recent years related to its own financial performance as much as the industry-wide problems. Nevertheless, the business outlook remains strong for this company as it already showed the capacity to make a strong comeback from the virus hit. Among its first competitors such as AMD and Nvidia (which you can also trade with FBS Trader), it looks very solid and competitive. With the SMR Rating as A (which is second-best after A+), Qualcomm’s EPS has 76 out of 99 possible points in EPS Rating. Therefore, currently, this stock appears to be a very option in the mid-term and long-term.

Until 2020, Qualcomm’s stock has been fluctuating around $70. That reflects the fact that it wasn’t making consistent returns back then. However, since early 2019, its trajectory transformed into a steady uptrend. That uptrend was crushed by the virus in March 2020 forcing it from nearly $100 down to $60. Since then – meaning, roughly during a year – the stock made a stunning comeback and leaped to the current $160. From the ashes, it made a 200% rise.

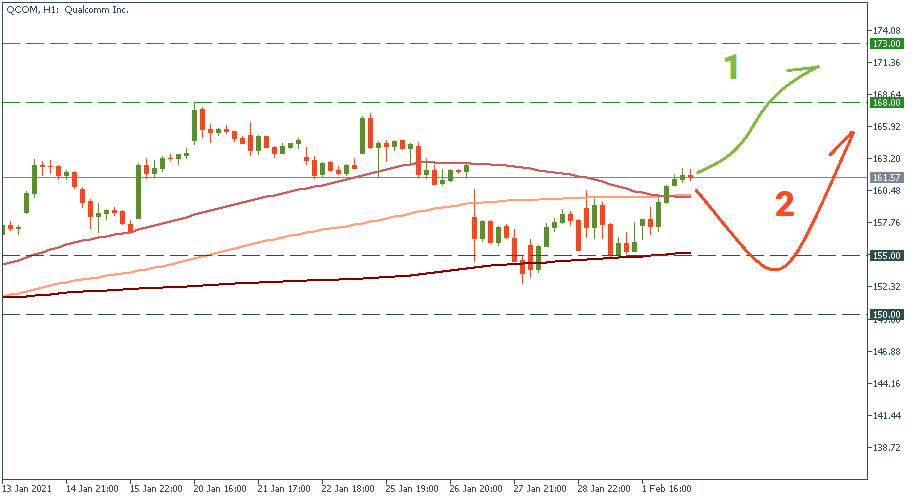

Scenario 1, beating the expectations: if that’s the case, this stock will likely cross the local resistance of $168 and move to $173

Scenario 2, underperforming: if the market is not impressed, the stock may go for a local drop down to $155 or slightly below, but then it will quickly recover and continue the uptrend.

Don't know how to trade stocks? Here are some simple steps.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!