-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to open an FBS account?

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

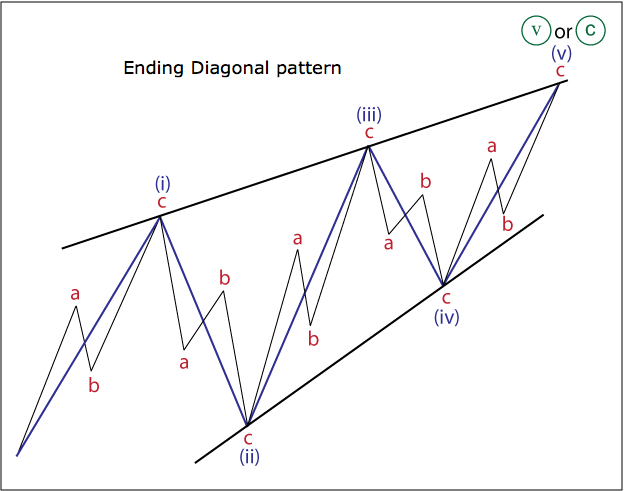

Ending Diagonal Pattern

In the previous article, we discovered a leading diagonal, which acts as the beginning of an impulse or a zigzag. Today we're going to examine a pattern, which serves as the top-stone of an impulse (wave 5) or a zigzag (wave C), so let's find out more about an ending diagonal pattern.

The main rules for an ending diagonal

- This pattern subdivides into five waves.

- Wave 2 never ends beyond the starting point of wave 1.

- Wave 3 always breaks the ending point of wave 1.

- Wave 4 usually breaks beyond the ending point of wave 1.

- Wave 5 in the absolute majority of cases breaks the ending point of wave 3.

- Wave 3 can't be the shortest.

- Wave 2 can't be a triangle or a triple three structure.

- Waves 1, 3 and 5 form like zigzags.

As you can see, the main difference from a leading diagonal is that the motive waves of an ending diagonal can be only zigzags. However, sometimes we might face some ugly structures, but generally the ending diagonal consists of zigzags. It's also possible to have sometimes double zigzags in a position of the motive waves of an ending diagonal, but we'll come back to this topic a little bit later when we go through all the correction patterns.

Types of model

There are two variations of the ending diagonal: contracting and expanding. Mostly, the first wave of a contacting ending diagonal is the longest one, but the expanding pattern usually has the shortest first wave (in both cases the third wave can’t be the shortest). Also, in the real-time wave counting, an expanded ending diagonal is considered riskier than a contracting one.

Examples

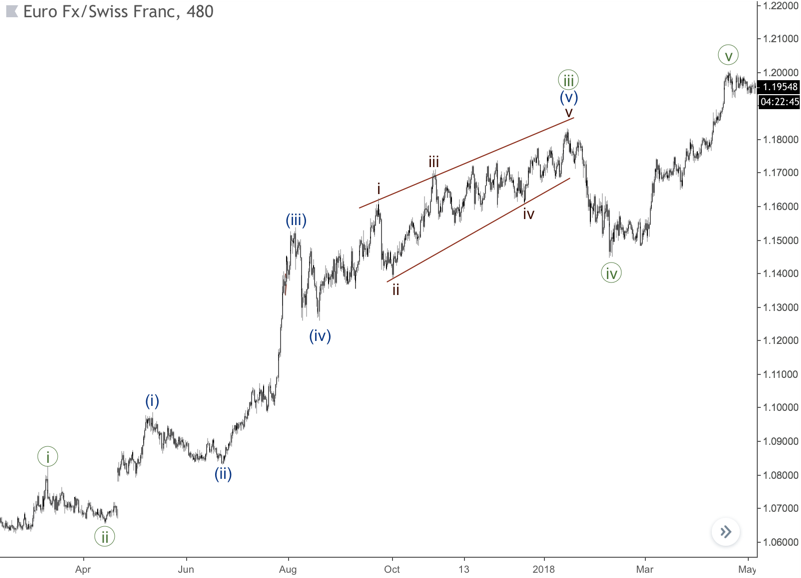

There’s a contracting ending diagonal in a position of the fifth wave on the chart below. As you can see, wave (i) is the longest and all the motive waves are zigzags. A pullback from the bottom diagonal led to a formation of a bullish impulse in wave (i).

However, sometimes the third wave of a contracting ending diagonal could be the longest. To be honest, this violates the rules from the book ‘Elliott Wave Principle: A Key to Market Behavior’, but the case happens on the markets quite often, so we should know what we could face with.

The next chart represents a contracting ending diagonal in wave 5, but the third wave of the pattern is longer than the first wave and smaller than the fifth wave. So, there’s a contracting diagonal with the longest third wave.

There’s another thing we should know about the ending diagonal. Sometimes the price just can’t reach a line from waves one and three as shown on an example below. The first wave of this pattern is the longest (remember, the third wave can’t be the shortest anyway). Because this pattern was formed in a position of the fifth wave of the bigger third wave, then we had a downward correction (wave ((iv))) and another bullish impulse (wave ((v))).

It’s also possible to have a contracting pattern with the longest third wave, but a line from waves one and three remains untouched by the wave five (check the next chart).

And here we are, there’s an expanding ending diagonal on the chart below. As you can see, the first wave is the longest. Also, the fifth wave hasn’t reached the pattern’s upper side. It’s a usual story for this type of an ending diagonal.

There’s one more example of the expanding diagonal. The fifth wave here also hasn’t reached the bottom line of the pattern, but have a look at wave (iii), which was formed like a double zigzag. There’ll be another article about this correction formation, but for now just remember that sometimes a motive wave of an ending diagonal could be not just a zigzag.

The Bottom Line

The ending diagonal is the end of an impulse or zigzag. This pattern consists of zigzags or more complex correction formations. A duration of a correction subsequent to a diagonal depends on a pattern’s position in a whole wave count.

2023-07-26 • Updated

Other articles in this section

- Structure of a Trading Robot

- Building a Trading Robot without Programming

- How to Launch Trading Robots in MetaTrader 5?

- Algorithmic Trading: What Is It?

- Fibonacci Ratios and Impulse Waves

- Guidelines of Alternation

- What is a triangle?

- Double Three and Triple Three patterns

- Double Zigzag

- Zig Zag and Flat Patterns in Trading

- Advanced techniques of position sizing

- Truncation in the Elliott Wave Theory

- Ichimoku

- What is an extension?

- How to trade gaps

- Leading diagonal pattern

- Wolfe waves pattern

- Three drives pattern

- Shark

- Butterfly

- Crab Pattern

- Bat

- Gartley

- ABCD Pattern

- Harmonic patterns

- What is an impulse wave?

- Motive and corrective waves. Wave degrees

- Introduction to the Elliott Wave Theory

- How to trade breakouts

- Trading Forex news

- How to place a Take Profit order?

- Risk management

- How to place a Stop Loss order?

- Technical indicators: trading divergences