-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to open an FBS account?

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

Quantitative Easing Policy (QE)

What is quantitative easing (QE)?

The main role in maintaining price stability belongs to a central bank. Central banks operate independently of the government. To support price stability, a bank must control inflation and create a stable economic environment. It could apply these measures through monetary policy.

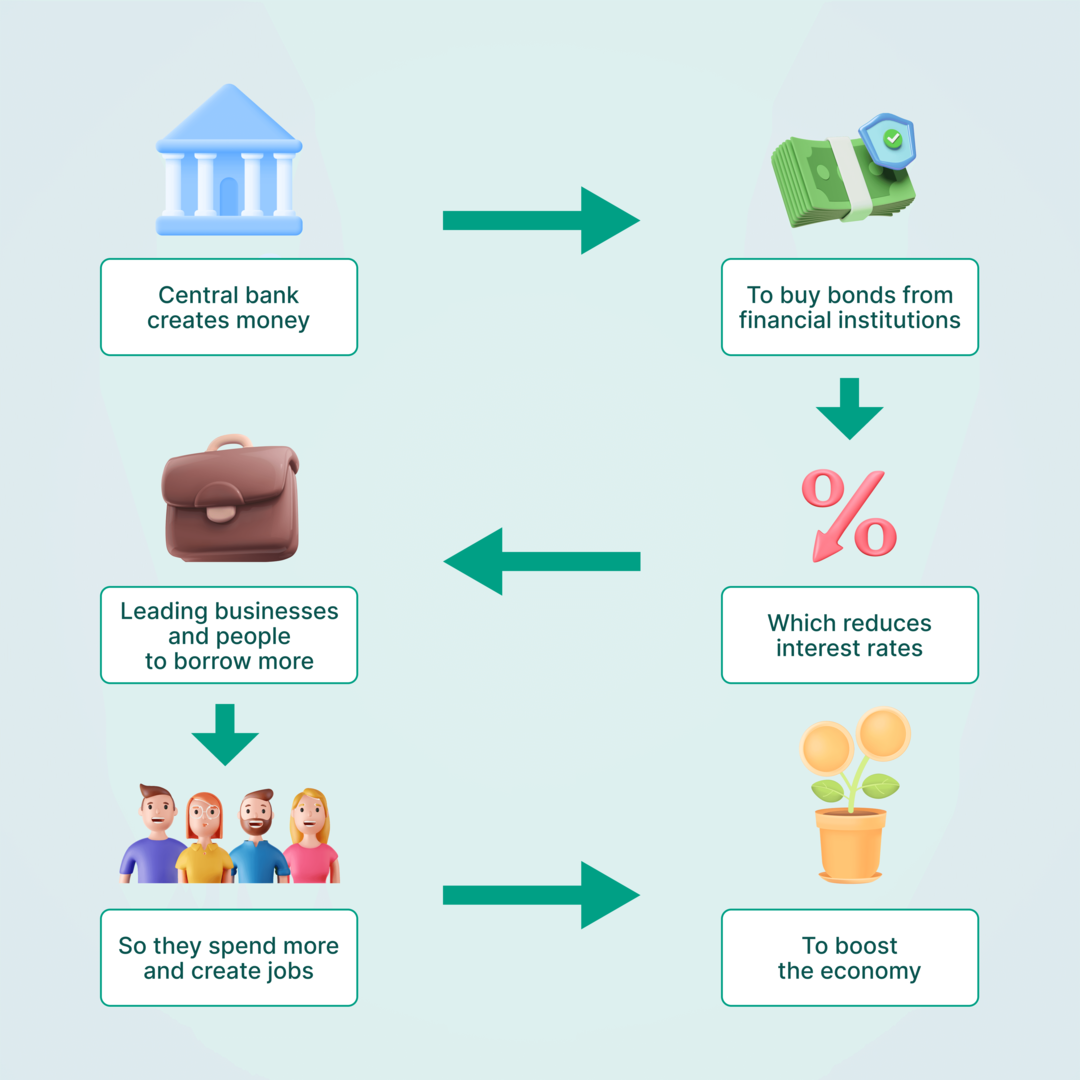

A simple explanation of quantitative easing

Quantitative easing is a tool used by central banks to help stimulate the economy by increasing the amount of money in circulation. They do this by buying financial assets such as government bonds from banks, which in turn can lend out more money to individuals and businesses.

There are two types of monetary policy: restrictive (tight, contractionary) and accommodative (loose, expansionary). The first one is conducted when the amount of money in the economy is so enormous that the bank increases the interest rate to reduce the money supply and decrease inflation. On the other hand, the accommodative policy is used when GDP growth is slow. In that case, a central bank increases the money supply and decreases the interest rate. Low interest rates attract investors and are intended to generate more cash inflows into the economy. When the rate falls to practically 0%, and a central bank still needs supportive measures, it applies quantitative easing.

How does Quantitative Easing Work?

1. The central bank creates new money electronically.

When a central bank, like the Federal Reserve in the US or the European Central Bank, decides to use quantitative easing, they create new money electronically. They don't print physical money, but instead, they enter new digits into their computer system, which allows them to increase the money supply.

2. With this new money, the central bank buys government bonds from commercial banks.

Once the central bank has created this new money, they buy government bonds from commercial banks. Government bonds promise to pay back the money with interest later. Commercial banks buy these bonds because they're considered a safe investments.

Remember that central banks don’t buy bonds directly from the government. That case is known as debt monetization (monetary financing), and it’s illegal in monetary policy for big economies.

3. The banks receive the new money, which increases their reserves.

When the central bank buys these government bonds from commercial banks, they pay for them with the new electronic money they created. This increases the reserves of commercial banks, meaning they now have more money to lend to businesses and individuals. This increased lending helps to stimulate economic activity and can lead to more investment, hiring, and consumer spending. This, in turn, can help to boost economic growth.

4. The increased money supply stimulates economic activity and can help lower interest rates.

By injecting more money into the economy through quantitative easing, the central bank can help to lower interest rates. When interest rates are lower, it's cheaper for businesses and individuals to borrow money, which can lead to increased investment and spending.

5. The goal is to boost the economy.

The ultimate goal of quantitative easing is to boost economic growth and prevent deflation during times of economic downturn. By injecting more money into the economy, the central bank hopes to stimulate economic activity, increase lending and investment, and prevent prices from falling too far.

When a central bank stops buying new bonds, it holds on to those in its balance sheet. If these bonds mature (most of them have a maturity date when the initial investment is repaid to the bond's owner), they are replaced by new ones. In addition, a bank can let bonds mature without replacement or sell them to the market.

Quantitative Easing vs. Printing Money

Purpose and scope

Quantitative easing involves creating new money electronically and using this money to buy government bonds from commercial banks. On the other hand, printing money refers to the physical printing of new banknotes and coins and is often used as a last-resort measure to address government debt or hyperinflation.

Control over the money supply

With quantitative easing, central banks have some control over the amount of new money they create and inject into the economy. For example, they can adjust the number of government bonds they buy to fine-tune the amount of new money in circulation.

When it comes to printing money, however, there needs to be more control over how much to print and how to distribute it. Printing money can lead to currency devaluation and rapid inflation if not treated correctly.

How does QE affect currency?

When a central bank increases the money supply, the price and purchasing power of the currency will fall unless other countries conduct a quantitative easing policy, too.

In simple terms, the country’s currency tends to fall over the QE process. For example, the USD lost 14% against other currencies since the Covid-19 pandemic started. It happened because the US Fed printed trillions of dollars and kept the interest rate at 0%.

Effects of Quantitative Easing on the Economy

Quantitative easing can increase the amount of money in circulation, increasing liquidity in the financial system. Thus, it’s easier for individuals and businesses to access credit. Investments are becoming more accessible, too.

One potential downside of quantitative easing is that it can lead to inflation in asset prices, such as stocks and real estate. It can create a "wealth effect," where individuals and businesses feel wealthier and more confident, leading to increased spending and investment. However, if asset prices inflate too much, it can lead to a bubble and, ultimately, a financial crisis.

For example, the QE programs implemented by the US Fed following the pandemic led to a surge in stock prices, with the S&P 500 index (US500) reaching record highs by 2021. Now, global stock markets suffer from this decision.

Why is QE so risky?

There are several reasons why this policy is considered as risky by analysts:

- It can generate high inflation and bubbles. Many experts are sure that QE can kick inflation very high.

- Some analysts criticize it for its ineffectiveness. They suggest fiscal policy (government spending and tax cuts) as the best solution to revive the economy.

- In the end, many experts suggest QE is just a way for governments and commercial banks to hide their problems and rely on the central bank to solve them.

History shows that quantitative easing risks are not theoretical but happen occasionally. You can find various examples below. And now, let’s look at quantitative easing benefits.

Advantages of Quantitative Easing

- It helps to stimulate economic activity during times of economic downturn.

- It allows central banks to inject new money into the economy in a controlled way.

- It helps to lower interest rates and increase lending.

- It helps people to withstand harsh times.

However, it’s important to remember that QE can lead to an increase in government debt. By the end of the day, the crisis of 2020, in which we are living now, was caused by an uncontrollable QE.

Example of Quantitative easing

The Bank of Japan (BOJ) started to implement QE in 2001. At that time, the economy faced stagnation and the rise of inflation. As the Japanese economy is doing pretty well, for now, BOJ threw some hints about exiting this program.

The Bank of England and the Federal Reserve applied quantitative easing during the 2008 crisis. The QE in the United States lowered mortgage rates, stabilized inflation, and improved employment. On the other side, it devaluated the US dollar.

The European Central Bank began its quantitative easing program in January 2015. The bank decided to stop the policy at the end of 2018, despite the slower economic growth.

Conclusion

There are many pros and cons to the quantitative easing program. On the one side, it supports a stagnating economy. On the other side, there are risks of currency devaluation and the creation of bubbles. Nevertheless, the effect of the policy can give a boost to economic activity during times of uncertainty.

2023-03-15 • Updated

Other articles in this section

- The McClellan Oscillator

- Aroon Indicator Trading Strategy

- Currency strength

- Moving Averages Ribbon: How to Find Entry Point

- Best Time Frames for Trading

- Renko charts Japanese candlestick chart

- Types of charts

- How to Use a Heikin-Ashi Chart?

- Pivot Points

- What Is a ZigZag Indicator?

- Moving Average

- Williams’ Percent Range (%R)

- What Is Relative Vigor Index (RVI Indicator)?

- Momentum

- Force index

- What Is Envelopes Indicator?

- Bulls Power and Bears Power

- Average True Range

- How to trade on central bank decisions?

- CCI (Commodity Channel Index)

- Standard deviation

- Parabolic SAR

- Trading with Stochastic Oscillator

- Relative Strength Index

- MACD (Moving Average Convergence/Divergence)

- Oscillators

- ADX Indicator: How To Use It For Effective Forex Trend Analysis

- Bollinger bands

- Trend indicators

- Introduction to technical indicators

- Support and resistance

- Trend

- Technical analysis

- Central Banks: policy and effects

- Fundamental factors

- Fundamental Analysis in Forex and stock trading

- Fundamental vs technical analysis